Foreclosure Rates Rising and Relief Programs Ending

Nationwide, residential foreclosures are up 29% from a year ago. This is largely due to the expiration of COVID-related government programs, including loan forbearance options and foreclosure moratoriums.

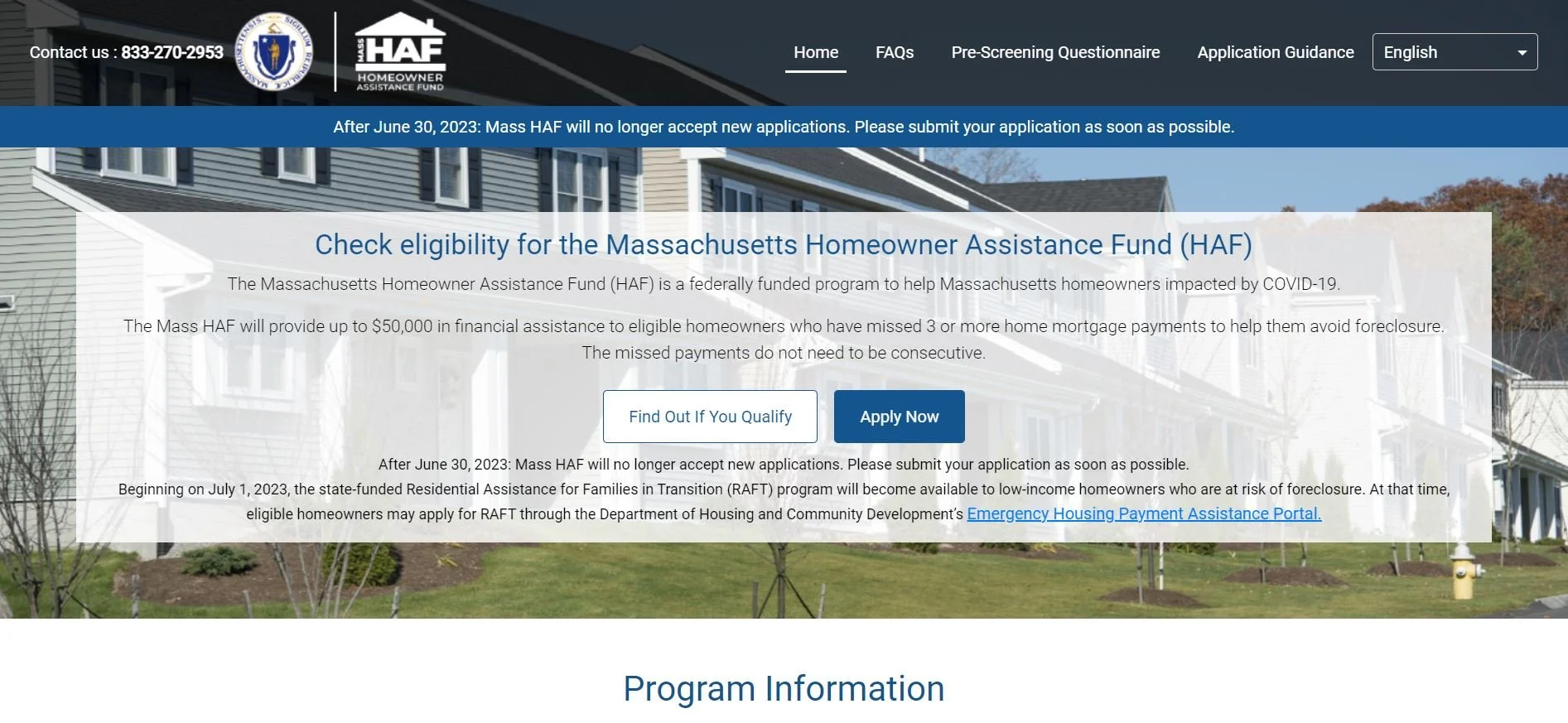

The Massachusetts Homeowner Assistance Fund (“Mass HAF”) can provide up to $50,000 to help eligible homeowners who have missed 3 or more mortgage payments avoid foreclosure. Massachusetts homeowners who own (and live in) a condo, single-family home or multi-family (4 units or less) property may qualify if they earn less than 150% of their town’s median income rate and have suffered some adverse financial impact due to the COVID pandemic – meaning the homeowner or a household member suffered a decrease in income OR an increase in living expenses after January 21, 2020. If your lender participates in Mass HAF, then once you apply for assistance, you are protected from foreclosure until your application is fully processed. For a list of participating servicers, click here.

But this program is coming to a close, and after June 30, 2023, Mass HAF will no longer accept applications.

For more information on this program and to see if you may qualify, visit Housing Assistance Program (massmortgagehelp.org)

There are other options to avoid foreclosure if you are in default on your mortgage, including temporary loan forbearance or loan modifications to bring your loan current again. If you have questions about whether you may qualify for Mass HAF, or other options to avoid foreclosure, contact us for a free consultation.